Here’s A Quick Way To Solve A Tips About How To Apply For House Loan

Follow these general steps to apply:

How to apply for house loan. Wait for the loan to be processed and cleared. Learn how to apply for a mortgage with bank of america’s digital mortgage experience ® and what you’ll need to complete an application. First things first, if you’ve already found your dream home, you’ll want to know the maximum amount you can borrow.

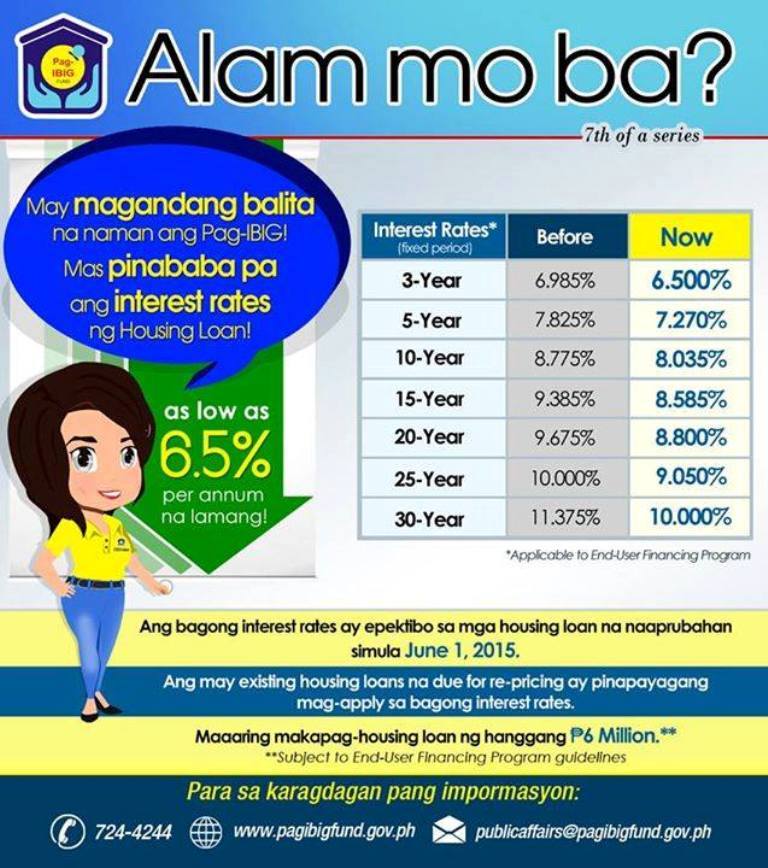

Find out how to lock in your interest. The first step in the mortgage loan process is to decide how much house you can afford, followed by preapproval, finding a home, choosing a mortgage lender. Begin by evaluating the specific renovations required to make your home safer and more accessible.

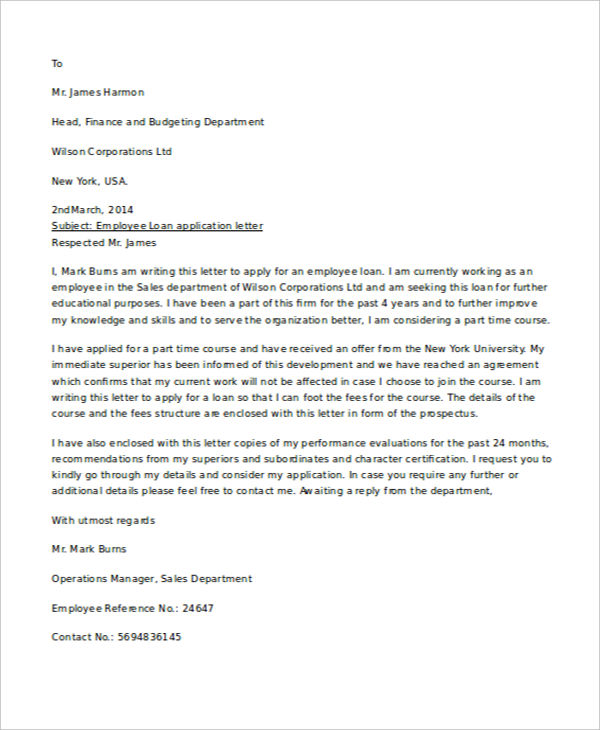

How to apply for a mortgage. Fill in an hsbc home loan application. Here are some helpful tips to prepare.

Find the right mortgage for you. It could make it easier to become a homeowner. Typically, you can apply for both a mortgage preapproval and a mortgage prequalification online.

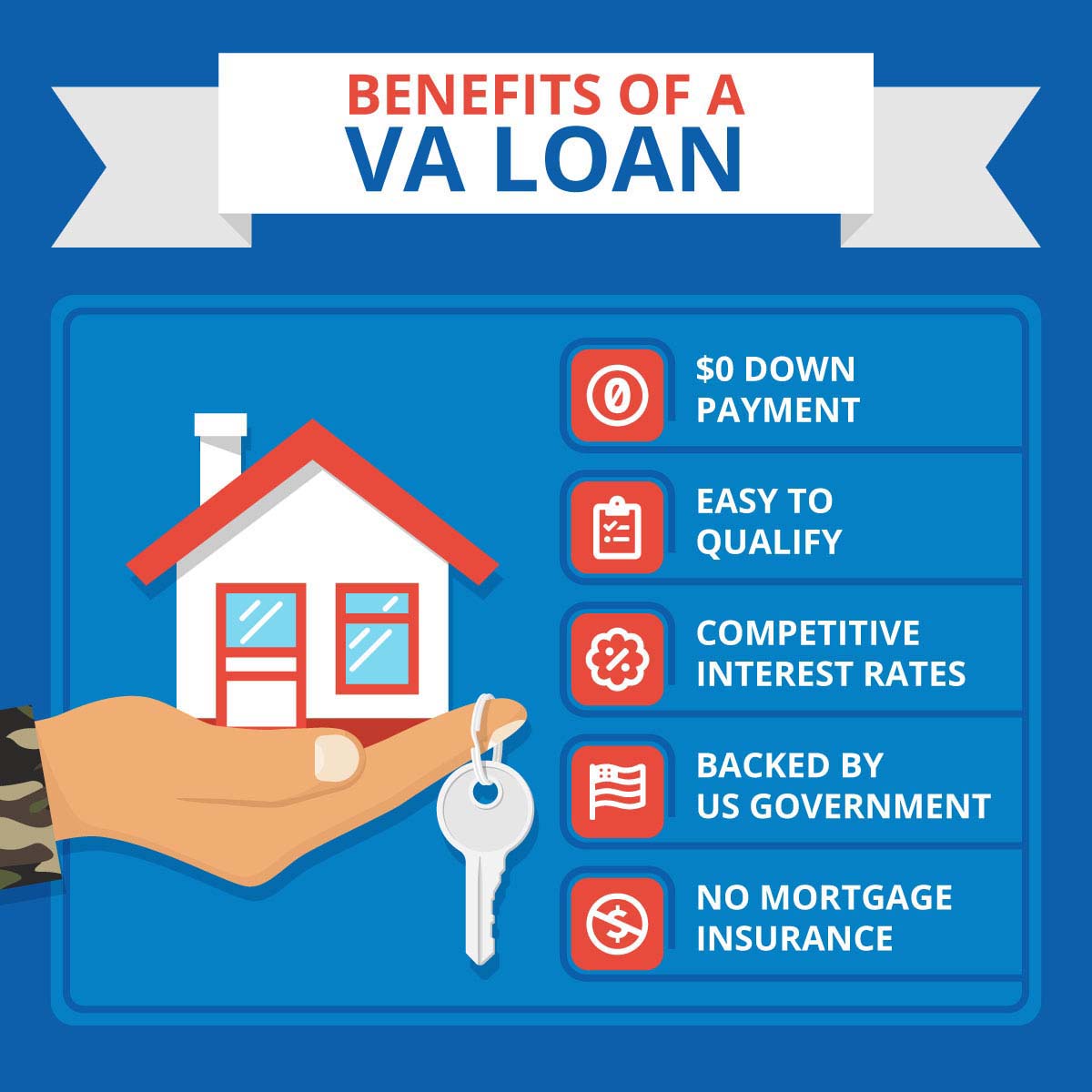

Provide us your credit approval letter and letter of current remaining debt from your previous bank. A new, more affordable repayment plan for federal student loan borrowers may come with another advantage: Qualification criteria for home loans vary by lender and loan type.

See what you qualify for. Learn about the different kinds of home loans we offer, then apply or speak to one of our experts to get the right mortgage for you. Get your finances in order.

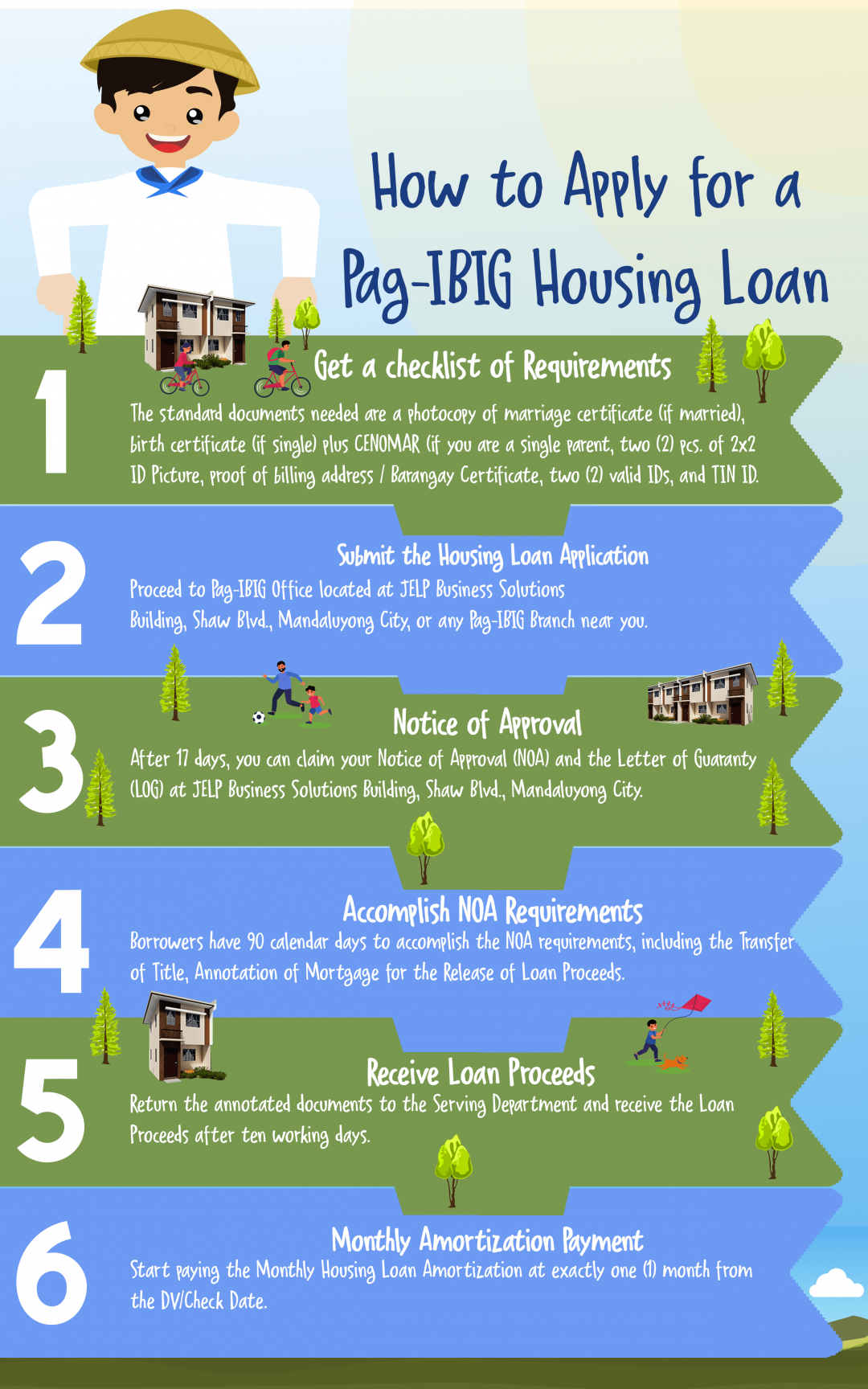

The next steps follow the same process for applying for our. This step takes time, so be patient and ready to respond to questions or. You may take the first step in owning a home by submitting your application form and its initial requirements via.

Applying for a housing loan is the first step to purchasing a property. Make a plan for the down payment. How to apply for a mortgage.

Learn strategies for saving a down payment, applying for a mortgage, shopping for a house and more. How to apply for a housing loan? Cancelling student loan debt for more than 930,000 borrowers who have been in repayment for over 20 years but never got the relief they earned because of.

To increase your odds of successfully qualifying for a mortgage, take some initial steps to get your financial house in order. What to do before applying for a home loan? Pick a lender you feel you can trust.