First Class Info About How To Improve Your Credit Score In 30 Days

Let's say you have a single credit card with a limit of $5,000.

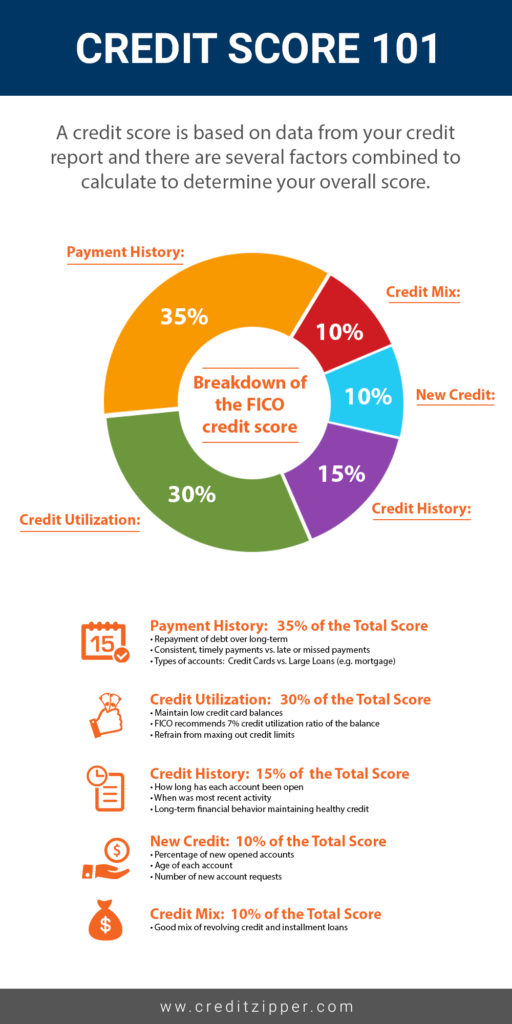

How to improve your credit score in 30 days. Did you know that with the right tools, you can know exactly how to improve your credit score in 30 days? Introduction improving your credit score can seem like a daunting task. Pay down credit card balances.

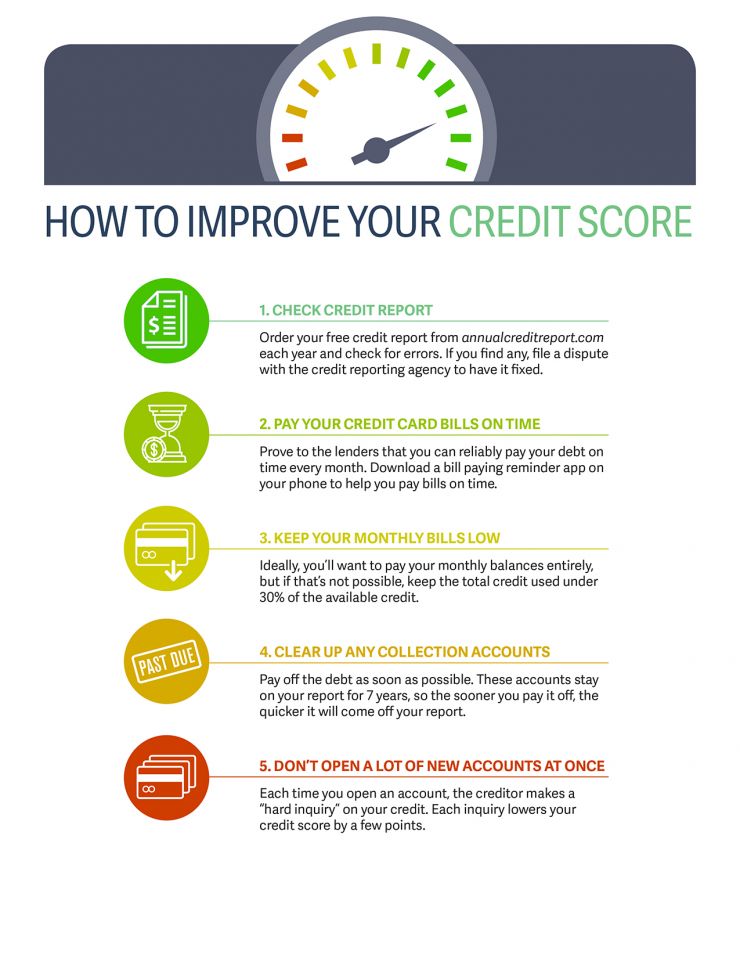

The first step in improving. Lower utilization ratios are good for your credit score. The representative should review the.

Being on the electoral roll gives lenders proof that you are who you. When calling your issuer, tell the customer service representative you’d like to request a credit limit increase on your card. Here's an example of how this would work.

In this post, we will review how to improve your credit score in 30 days by following these 10 steps. Reduce your utilization ratio. Taking control of your finances is another fundamental step toward fixing your credit.

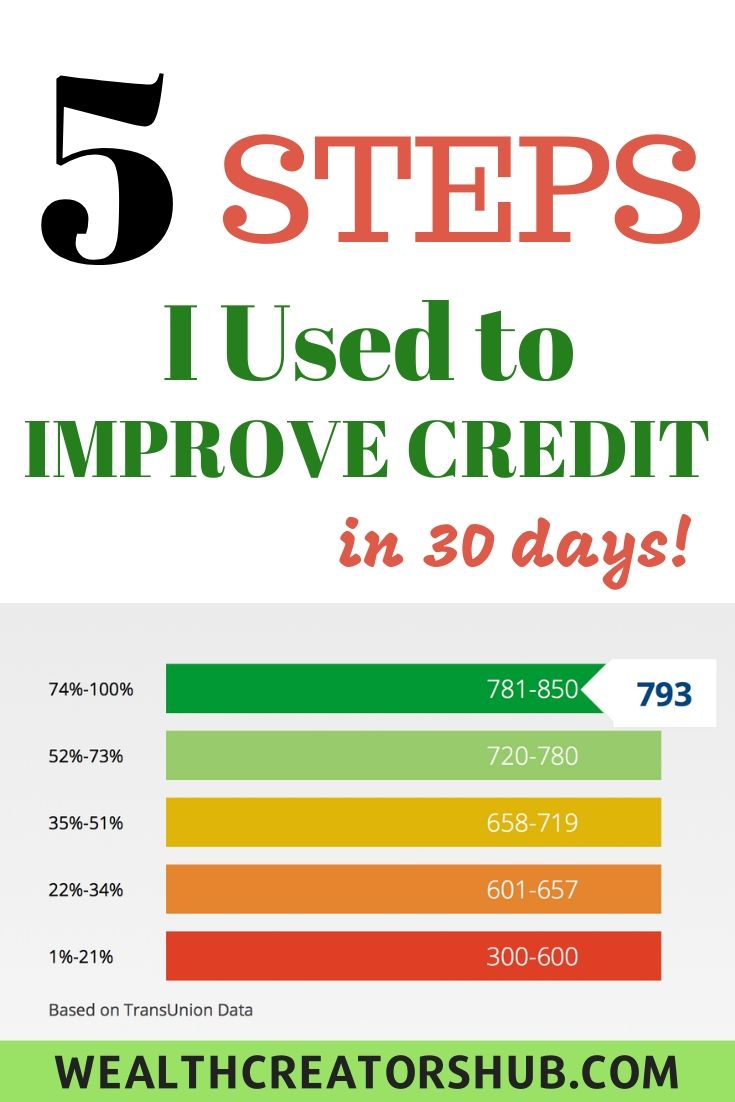

Get a copy of your credit report. But you can build it up almost as fast! As you use more of your available credit and your utilization ratios climb, it has a negative impact on your.

4 tips to boost your credit score fast if your credit score is below average, there are ways to improve it — some provide quicker results than others. Develop a budget and stick to it. This is possibly the easiest way to help build your credit rating.

Become an authorized user 4. Start by creating a realistic budget that. Ask for a credit limit increase 3.

A credit score can drop fast. Even though you pay it off in full every month, the card still has an. Dispute inaccurate data on your credit reports.

Dispute inaccurate data on your credit reports let’s summarize… Here are the ranges experian defines as poor, fair, good, very good and exceptional. 2.1 amend any late or missed payments 2.2 stay on top of your payments 2.3 correct any mistakes on your credit report 2.4 work to reduce your outstanding debts 2.5.

Last but not least, you can improve your credit score in 30 days by disputing inaccurate entries or information on. One of the simplest ways to improve your credit score is to lower your credit utilization, which is simply the portion of your. If you’ve been keeping an eye on.

![7 Tips to Increase Your Credit Score [Infographic]](http://www.trimurty.com/blog/wp-content/uploads/2016/12/Infographic-7-01-1.jpg)

/images/2020/01/07/raise-credit-score-in-30-days.jpg)