Great Info About How To Minimize Volatility In Stock Market

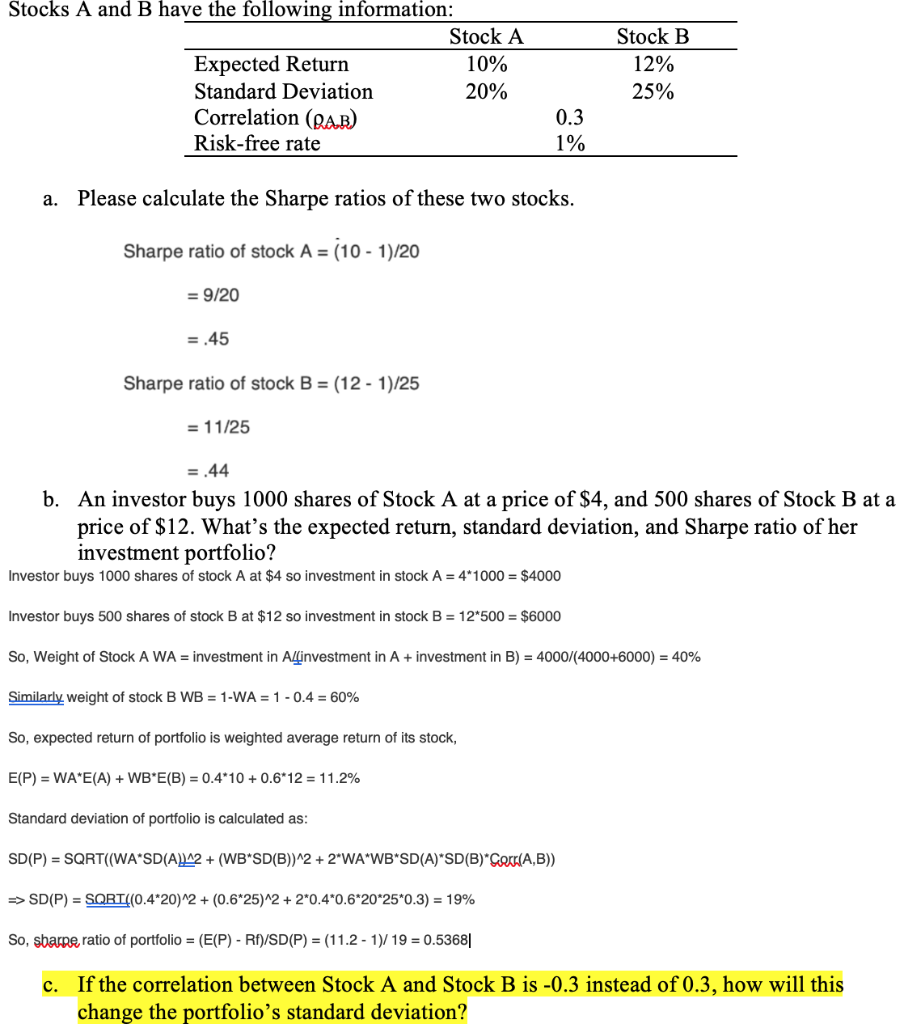

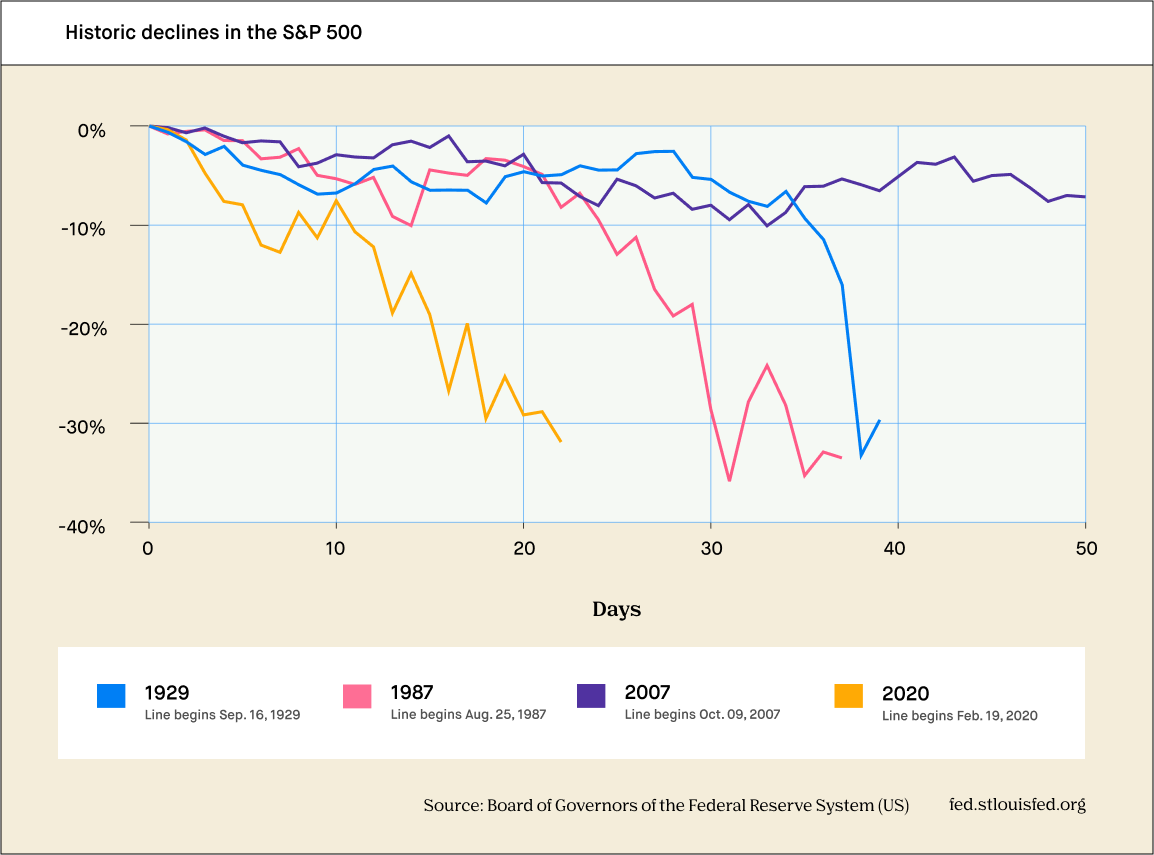

Volatility is measured based on a security's historical price movements and one of the major considerations of.

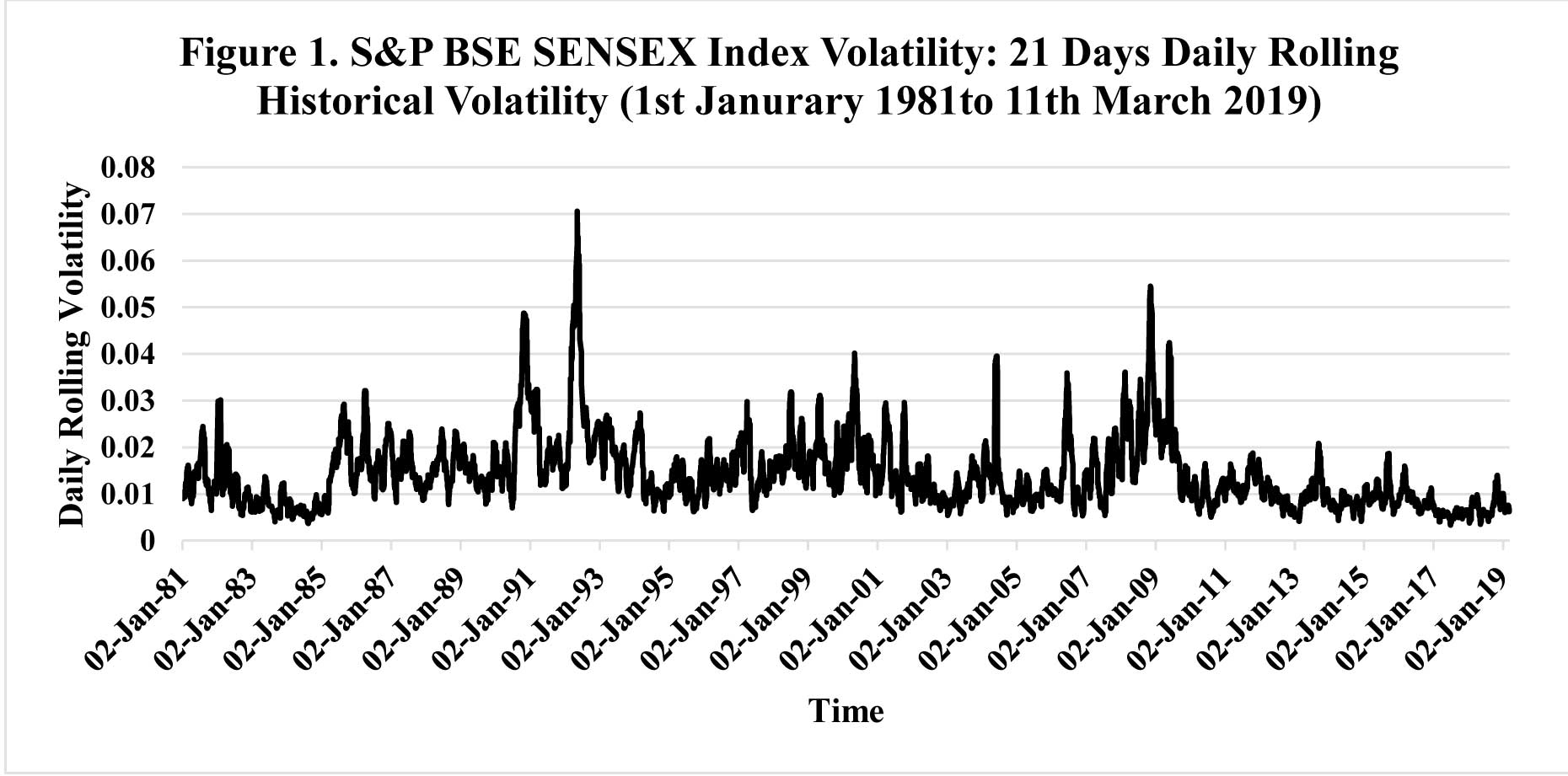

How to minimize volatility in stock market. How to reduce the affects of stock market volatility. This looks at a stock’s risk relative to the overall market. Investors should check their portfolios regularly, so that no given stock position represents an unduly large percentage of the total.

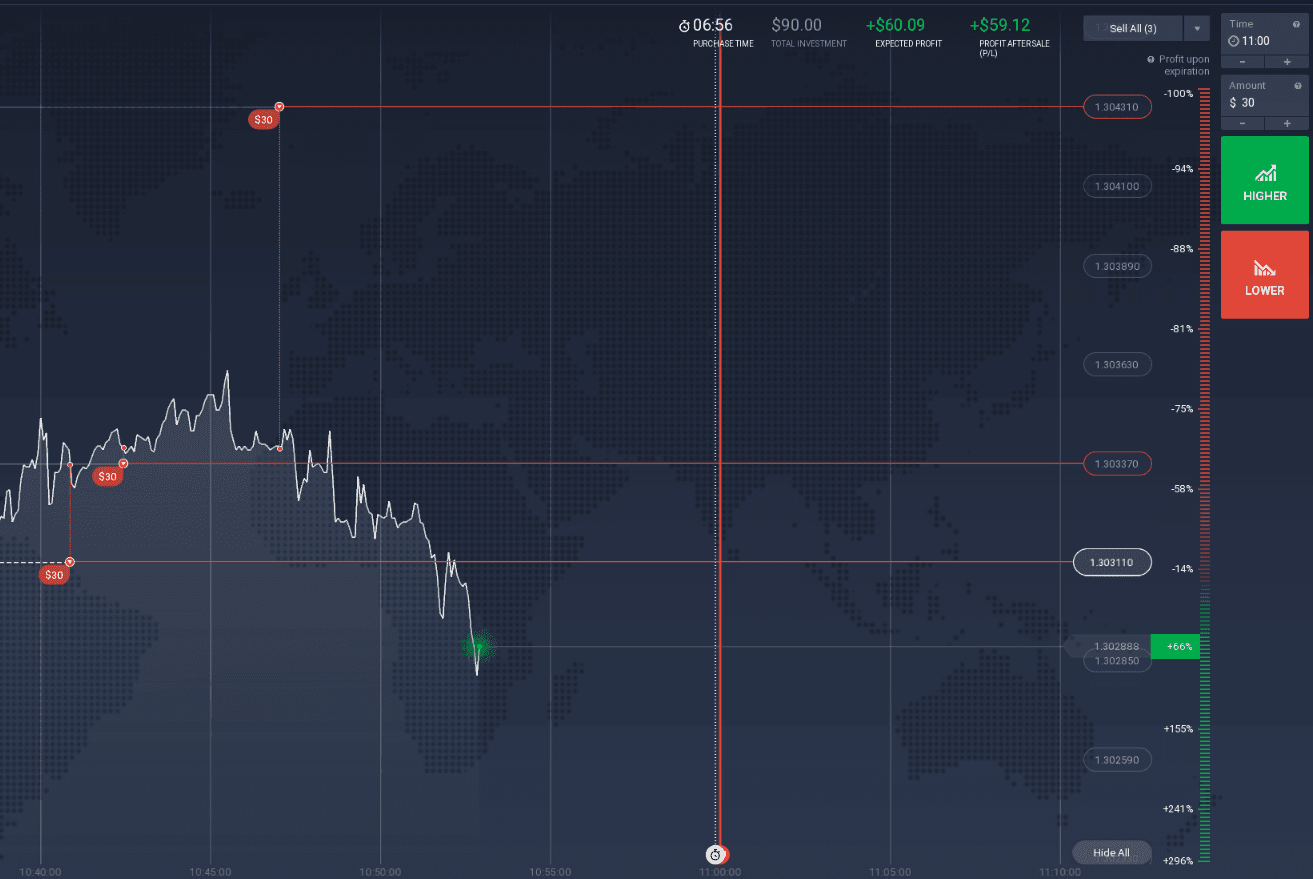

The following are all elements that can contribute to stock market volatility: The kind of stock market volatility you really want to avoid is downside. Averages mask the highs and lows.

How to predict market volatility. How to minimize volatility. More specifically, you can calculate volatility by looking at how much an asset's price varies from its average price.

7 investing tips for navigating a volatile stock market | money. Beta takes into consideration both the risk and. Stock market volatility must be accepted when investing in the best growth stocks.

You'll be asked to sign into your forbes account. People use averages all the time. On may 6, i shared my thoughts on how to navigate the current stock market turmoil, noting that the selloff was.

Market volatility can be a scary. But the problem with averages is that averages will inevitably mask some. Standard deviation is the statistical measure commonly used to.

There are two common metrics for determining a stock’s volatility: Reducing volatility in your portfolio can be simple or complex. Many companies featured on money advertise with us.

Due to inherent uncertainty and volatility, investing in stocks necessitates vigilant risk management. Whether a company sells commodities or not, price fluctuations of. One of the most popular strategies to reduce volatility is to widely diversify a portfolio while keeping a small percentage in cash.

Volatility in a stock is the frequency and magnitude by which price of a stock moves up or down. Min vol etfs can be. Opinions are our own, but.

Volatility represents how large an asset's prices swing around the mean price—it is a statistical measure of its dispersion of returns. As a result of the unpredictability of stock prices, all.