Brilliant Tips About How To Buy Convertible Bonds

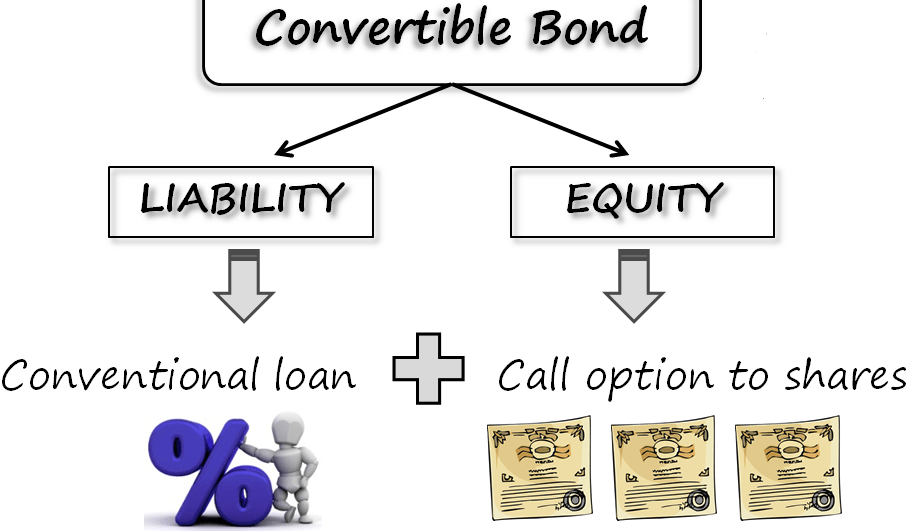

Convertibles are securities, usually bonds or preferred shares , that can be converted into common stock.

How to buy convertible bonds. Convertible bond calculation example. How to buy convertible bonds conclusion faqs get started with a stock broker what is a bond?

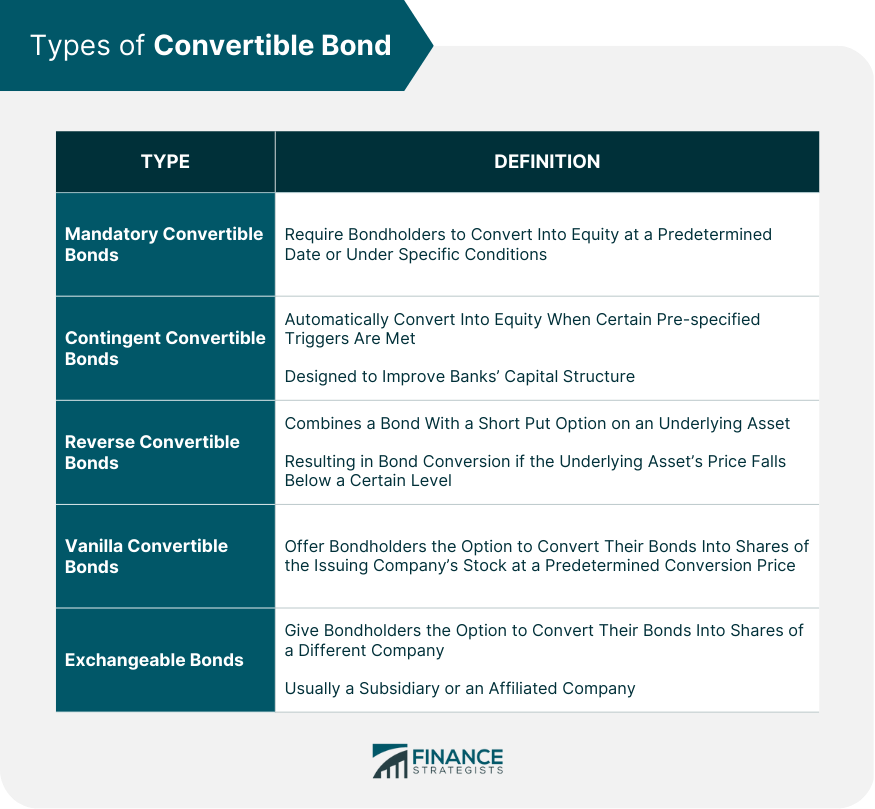

How to invest in convertible bonds investment in bonds can be done in a few easy steps with quick kyc, bond selection and a convenient payment gateway. A convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined number of shares in the issuing. As the name suggests, convertible bonds are corporate bonds issued by companies that are able to be.

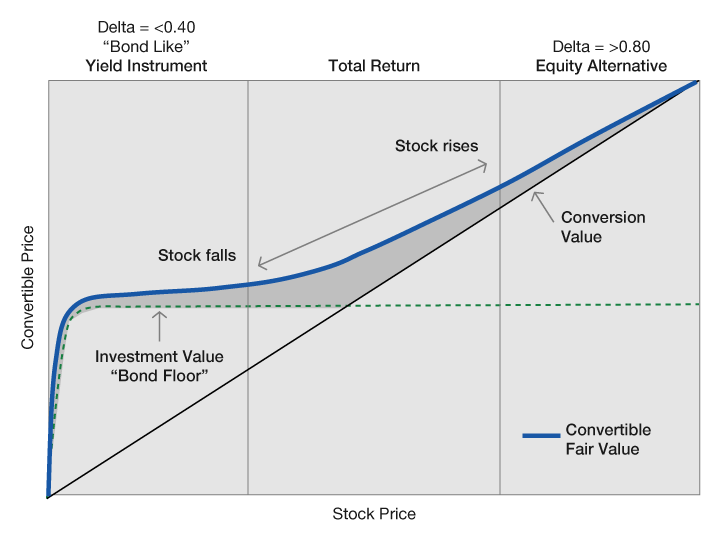

It is a hybrid security that combines features of. Read more convertible bonds are a form of corporate debt that also offers the opportunity to own the company’s stock. The convertible bond offering provides investors with the option to buy the stock at a discounted price, so if the company’s stock price rises above the.

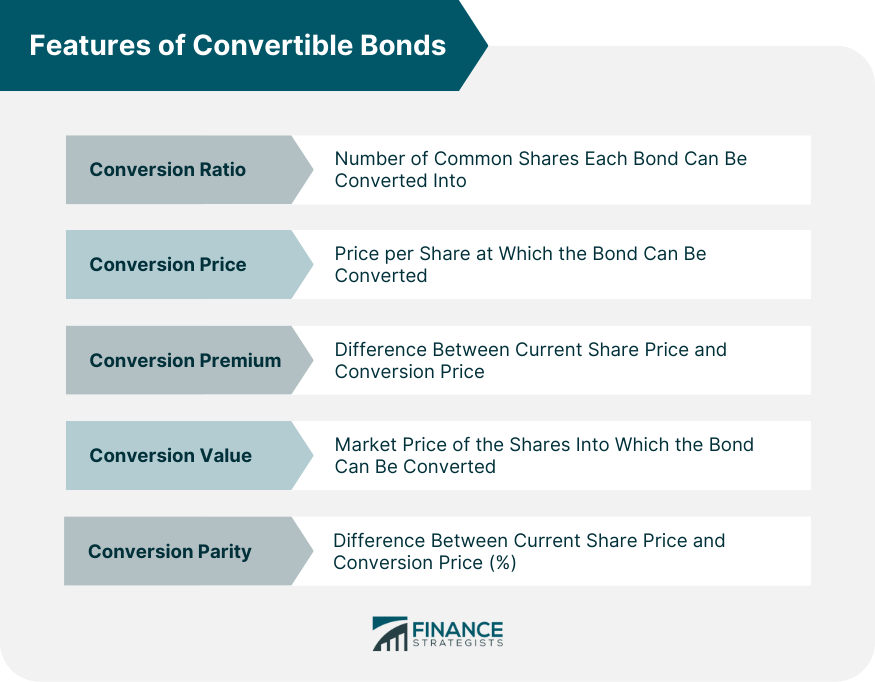

Convertible bonds have some unique characteristics. A convertible bond is an investment vehicle that starts as a bond and then can turn into a stock. They are issued by companies to raise capital and have a nominal value and a limited term.

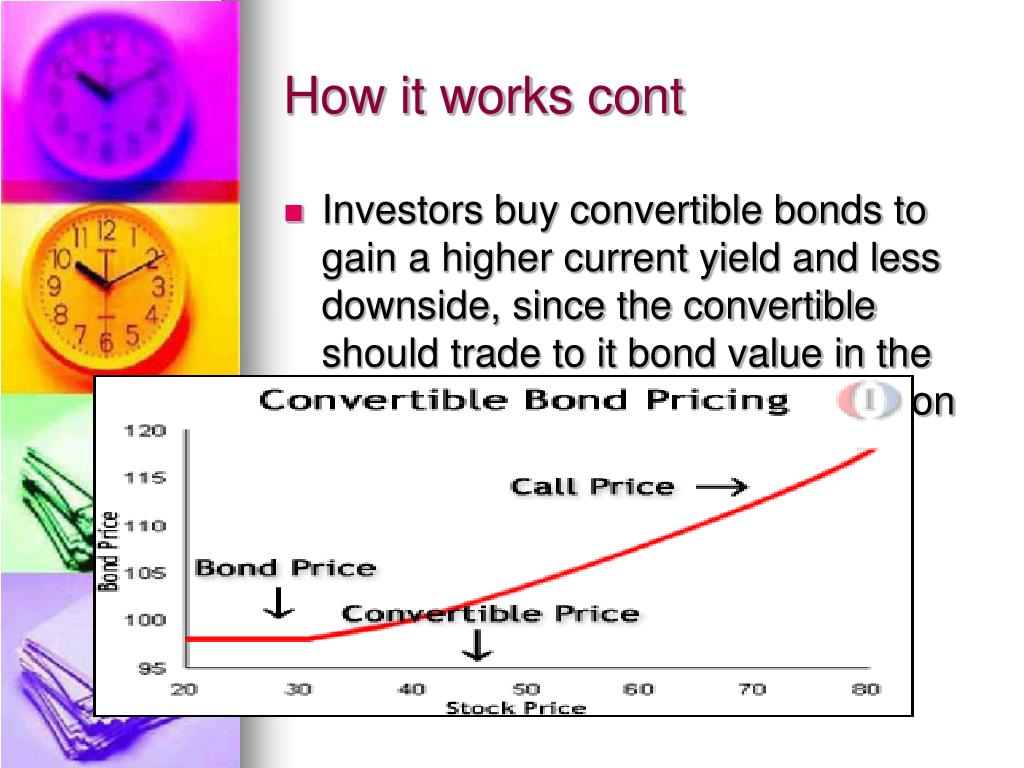

These are standard in all convertible bond types, and understanding these terms is important before negotiating. The volatility and return potential are driven by the value of the bond’s interest and redemption payments and the value of the equity. In this article we explore how they work, why they exist and when they might be good.

Like regular bonds, they offer regular. The convertible notes are being offered and sold to qualified institutional buyers. A convertible bond is a type of bond that can be exchanged for a predetermined number of shares of the issuing company’s stock.

You must enter the stock symbol. Nov 13, 2020 convertible bonds can be an attractive option for investors looking to supplement their income needs without sacrificing growth opportunities. Convertibles also have greater price volatility.

Lyft) today announced its intention to offer, subject to market conditions and other factors, $400 million aggregate principal amount. Updated june 06, 2022 reviewed by andy smith fact checked by suzanne kvilhaug there are pros and cons to the use of convertible bonds as a means of financing by.